This is the most simple technical analysis we need on understanding what is going on with BTC at the moment. There is no need to go overboard with complex technical indicators when Bitcoin price action shows us something as simple and significant as this.

This move, combined with the rather “sketchy” activity of Bitfinex wildly printing Tether tokens of recent, could explain why this is happening.

First, let’s look at the critical move which could be a foretelling of the short term movement of Bitcoin price action…

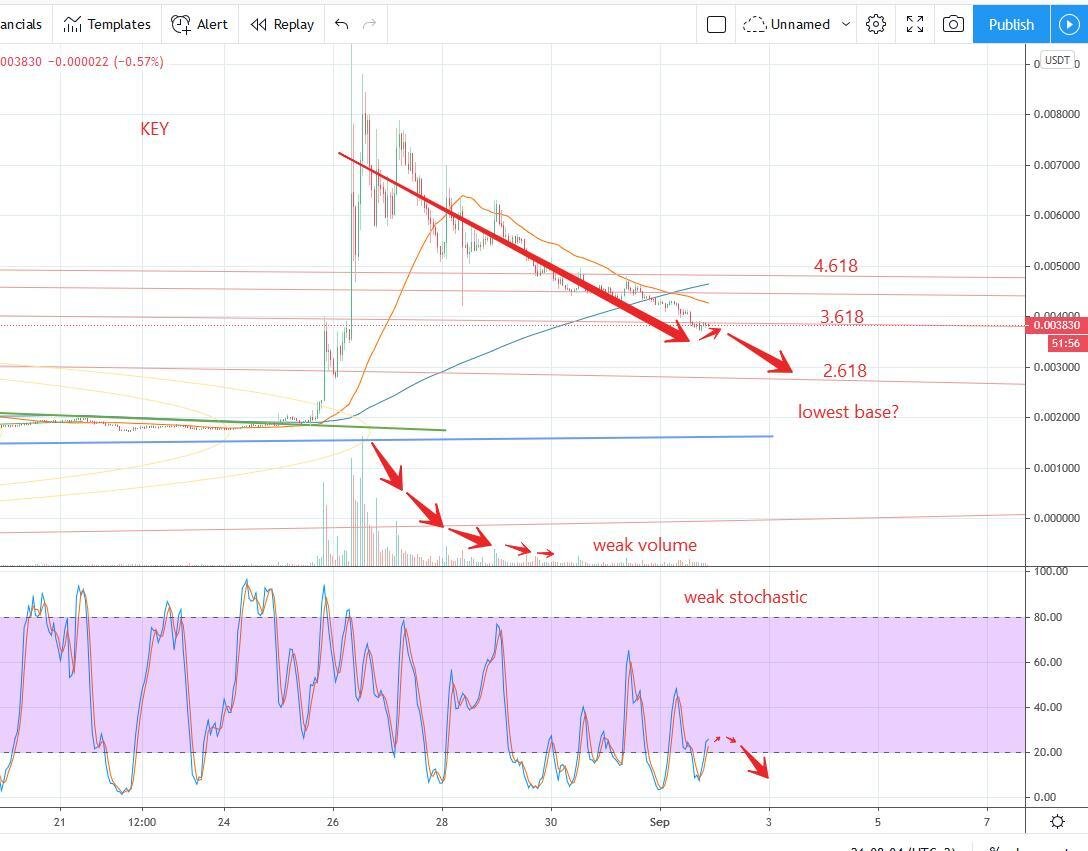

When you draw a baseline from March 29th 2019 to June 9th, 2019, which by the way seems to be a popular baseline of analysis by many prognosticators of the day, we see that the Bitcoin price line has violated this base of support for the first time since this rally picked up a full head of steam.

We have already watched a major lower high form, along with 2 major lower lows, which is already an indication of possible trend reversal. I’ll be posting a more detailed analysis of these critical pivot points on the next post. But combining those facts with the current violation of the base leaves a clear indication that the short term bull run might be ending.

All hope is not lost, however. This current bull run has been highly suspect from the jump. Why? Because Bitcoin has NEVER cut short the standard market cycles over time, since its inception. The four phases of accumulation, consolidation, markup, and distribution have followed a steady trend of increasing in length of time to develop. This is a very normal and standard way that all markets develop.

But when the run to the all-time high in 2019 broke free from the standard cycle time and cut it short, I was suspicious. I truly believe that the run-up was fueled by the continuous “printing” of Tether by the Bitfinex Exchange, which continuously happened in large chunks of millions of Tether tokens.

This smacks of manipulation and conflict of interest. Why would the Securities Exchange Commission allow it to continue? We may never know. But what we do suspect is that Bitfinex does NOT hold a one-to-one backing of Tether tokens as they claimed when the token was first introduced into the market.

As per Bitfinex, the Tether token was introduced to allow faster movement in the market, providing a much-needed bridge between Bitcoin and other altcoins, to facilitate quicker settlement and movement in and out of fiat currency & cryptocurrencies. The concept was that every Tether token was backed by $1 in USD to provide liquidity, should a “run on the bank” (or the Tether token) occur.

But as time went on, the regulatory authorities and news reporting agencies suspected that the Tether token was not backed 100% by USD reserves. Now it is plainly obvious that it is not. What I believe is happening is that Bitfinex is “betting” on a small percentage of people cashing out their Tether tokens for USD after making trades.

In other words, when an individual cryptocurrency investor sells their Bitcoins, they are placing their bets on the majority of people holding on to their Tether tokens to trade them into altcoins, or wait for the price of Bitcoin to move rather than cashing out and converting the Tether into USD to be deposited back into their bank accounts.

This is the same game that banks play when they only hold a fraction of the amount of money from deposits of their customers. If you have $1 million in a bank account, the bank will leverage that deposit and lend it out many times over. It is a gamble, but as long as there isn’t a “run on the bank” (think Mary Poppins and the bank disaster), the bankers will make fortunes leveraging the deposits of others.

Each time Bitfinex printed millions of Tether tokens, they were able to gobble up BTC at higher-than-market prices, which could be why the price of Bitcoin rose so fast. But this scam would not be possible if Bitfinex were forced to show proof of the 1:1 backing of the Tether tokens if they were audited.

This is my theory of why Bitcoin price was driven up beyond the normal value, which had the result of spurring a run before the bear market cycle was completed. Now we are seeing the BTC price coming back down to Earth, heading towards the 100-day exponential moving average.

By the time this correction is done, we might be right back where we should be, completing the bear market cycle in the time frame that it should have run its course. Time will tell.

As always, this is not financial advice, and I am not a financial advisor. I am just the skeptical Cryptocurrency watchman, exposing the evidence of cracks in the foundation like Sherlock Holmes!

Until next time, let’s enjoy the action. More to come!

Carlton Flowers

The CryptoPro