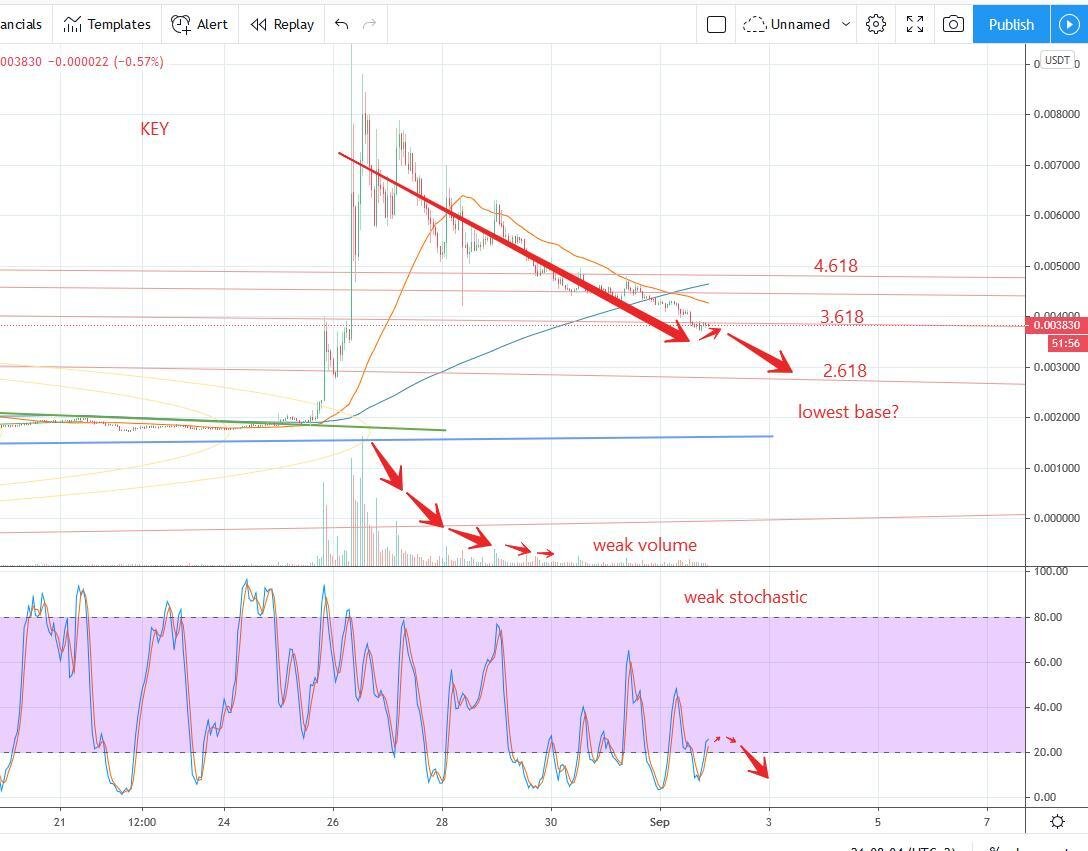

SelfKey is a project you cannot take a nap on. In the last few months, we’ve seen major price pumps in the blink of an eye. As KEY holders anticipate the possibility of a strong news release, I’ve got my eyes on the chart for clues that underscore the rumors.

Since the minor pump that took place on October the 19th, KEY has shown a very strong, but quiet period of consolidation as the base price has been creeping up ever so slowly. I think it is winding up the coil for a big breakout, or at least a mild break and rise to a higher base level.

The stochastic cycle has shown a similar coiling up action, as the peaks and lows have not returned prices that are outside of the current consolidation range. The longer this takes place, the harder the breakout could be. The break could go either way, but all indications show that a break to the up side is a greater possibility.

Take note of the OBV after the October 19th spike. We notice that the level did not go back down after the price line corrected. This is a good sign, indicating the possibility of institutional investors holding on to their bags with a tight grip. My interpretation is that something big must be on the horizon, because the majority of people are accumulating and not selling off their positions.

I’m already holding a decent bag of SelfKey, but if we do correct and break the upward trend that has been established, I’ve got a “strike zone” set just above the 2nd base level on the chart. We see small volume profile nodes hiding below the massive POC, and these would be the most probable landing points if a strong correction takes place across the alt market.

I do strongly believe that we are going to have one more correction before “alt season” hits, and that could happen when BTC peaks at $20k and starts its final correction before the continuance of the bull market. SelfKey is one of my most favorite projects, due to the strong fundamentals, use case, and price chart. Plus, I think KEY has the biggest potential for a 10X to 100X return over the next 6 to 12 months. But that is purely my opinion, and this is still a gamble.

Carlton Flowers

The Crypto Pro

Earn FREE Tokens on Coinbase!

CLICK HERE for the Compound (COMP) tutorial

CLICK HERE for the Stellar Lumens (XLM) tutorial

CLICK HERE to sign up for Coinbase and get $10 free Bitcoin

Visit the CryptoPro YouTube channel here by clicking the link or image below!